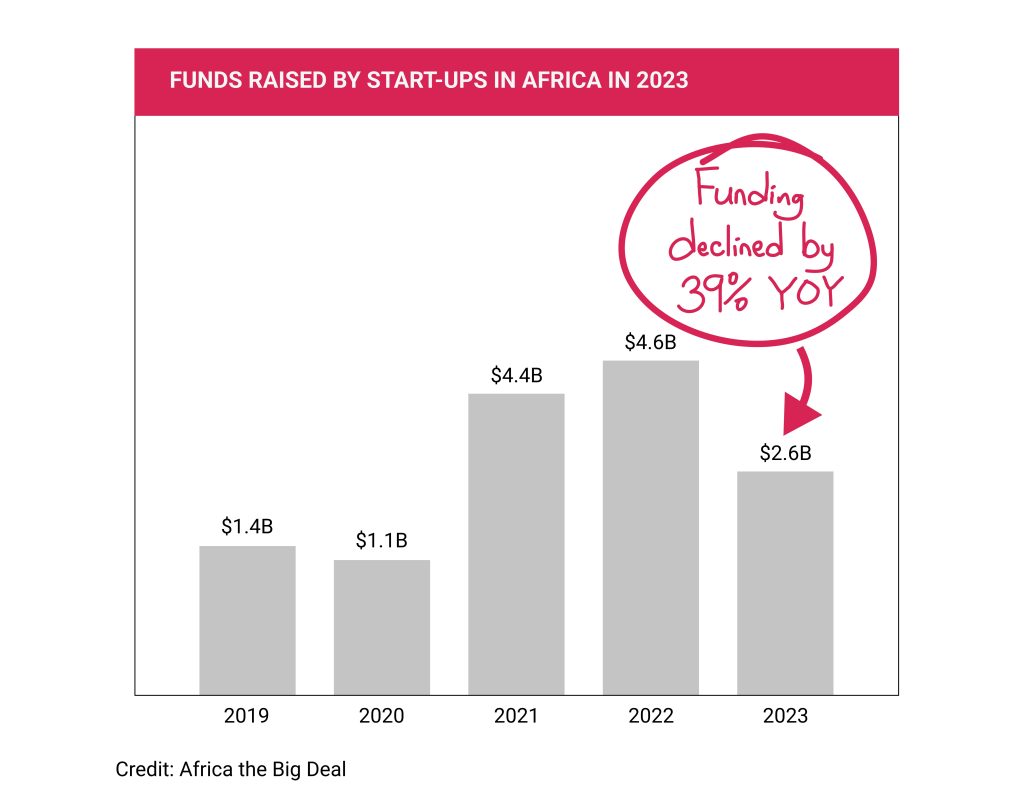

Investments in the African ecosystem have been constantly declining. African startups secured $1.3 billion in funding in the initial nine months of 2023, marking a decrease from the $3.3 billion and $2.9 billion raised during the equivalent periods in 2022 and 2021.

However, a few venture capitalists are willing to take a bet on a considerable number of African startups in 2023. Below are the Top 10 venture capital investors in Africa in 2023 according to the number of deals as compiled by Africa: The Big Deal

1. Techstars

Techstars is an accelerator and a pre-seed venture capitalist firm that provides all-around support to early-stage founders, which includes capital and mentorship. It was founded in 2006 by David Cohen, Brad Feld, David Brown, and Jared Polis. Techstars runs accelerator programs across North America, Europe, the Middle East, and Africa.

Industries: Industry-agnostic

Stages: Early stage

Number of investments: 3,700+ in the world, 112 in Africa

Number of deals in Africa (2023): 39 so far

Number of exits: 451 companies

Funds raised: $26B

Remarkable portfolio Companies: Chainalysis, DataRobot, Remitly

Investment Criteria: If you want to ace the Techstars application, you must match the following four criteria, in order of importance:

Team: Techstars prioritises the founding team of any firm they invest in. At any point of the application process, you must demonstrate why you believe the founding team is the ideal set of people for the task. Techstars is more concerned about your ability to learn, grow, and persist over time.

Market: Here are a few questions you need to answer on this issue before making that application: How well do you understand your market? Is the market large enough to invest in? Are people willing to pay for this solution to the stated problem now? What is its potential for future growth?

Demonstrating that you are targeting a significant, dynamic market will significantly enhance your application and show that your startup is positioned for sustainable success.

Traction: Simply put, traction is evidence that your target audience accepts your solution. It shows your progress in attracting customers, meeting market demand, and generating revenue.

Traction can come in the form of a prototype, survey responses, corporate interest, signups, or any proof that people are engaging with your solution.

Idea: While a strong idea is essential, it doesn’t need to be set in stone. Techstars understands that ideas may evolve based on feedback, data, or market shifts. Be open to refining your idea to find what works.

These criteria apply to your startup, whether it is an early-stage startup or a Stage C startup. Techstars will be willing to make a sizeable investment as long as these four criteria are met.

2. Google For Startups

Google for Startups, launched in 2011, is an entrepreneurial program designed to connect founders with the right people, provide essential training and resources, and offer financial support to drive business growth.

They assist startups through various initiatives, including the Founders Fund and Accelerator.

Industries: Industry-agnostic

Stages: Early-stage and Growth stage startups

Number of investments: 557

Number of deals in Africa (2023): 27 so far

Number of exits: 65 companies

Funds raised: Not specified

Remarkable portfolio Companies: NestAway, Yuimedi

Investment Criteria: Google for Startups seeks Pre-seed to Series A startups with Black or Latino founders, scalable products, strong market potential, defensible growth models, and readiness for global expansion.

3. KfW DEG

Deutsche Investitions- und Entwicklungsgesellschaft (DEG) is a subsidiary of the German state-owned investment bank, KfW, which was formed in 1948 after World War II.

The aim of this prominent investment company is to finance private companies in developing countries, contributing to the growth of emerging economies and the standard of living in these countries.

They offer long-term advice and loans or equity investments to SMEs and private firms, as well as local banks and financiers, who will in turn provide these funds to businesses.

Industries: Industry-agnostic

Stages: Unspecified

Number of investments: 1300+ companies

Number of deals in Africa (2023): 20 so far

Number of exits: Unspecified

Funds Invested: EUR 9.2 billion

Remarkable portfolio Companies: Copia Global

Investment Criteria: Their investment criteria are unknown. However, KfW DEG’s impact objective can provide a faint view of what they look for in a startup: “What DEG wants to achieve is for our clients to provide more and better jobs, increase local income, and support transformation in developing markets while acting in a sustainable manner and creating benefits for local communities.”

4. Launch Africa

Launch Africa Ventures is a top-tier venture capital fund focused on bridging the funding gap for Seed and pre-Series A investments across Africa.

The fund channels its resources, expertise, and global connections into supporting early-stage tech startups with scalable solutions and strong management, primarily in B2B and B2B2C sectors.

Industries: Industry agnostic

Stages: Early Stage

Number of investments: 142 companies

Number of deals in Africa (2023): 17 so far

Number of exits: Unspecified

Funds Invested: US$36.3mn

Remarkable portfolio Companies: Lengo AI, Fixit45, Zanifu, Termii

Investment Criteria:

Launch Africa invests in early-stage startups focused on B2B and B2B2C models, meeting the following criteria:

- Startups should be technology-driven, led by strong management teams, and offer scalable solutions.

- Ideally, they should be ready for a $5 million+ Series A round within 6–24 months and have graduated from reputable accelerator programs, though this is preferred, not mandatory.

- Financially, startups should generate at least $25,000 in Net MRR, with 10% month-over-month growth, and have an international expansion mindset within a year of investment.

- Ventures incorporated in investor-friendly jurisdictions like the U.S., U.K., Singapore, or the Netherlands are preferred, with 100% ownership in African subsidiaries.

- Successful pilots, PoCs, or partnerships with corporate entities (banks, telcos, insurers, etc.) are valued.

- The core team and operations must be based in an African market, showing commitment to the region.

While these criteria generally guide investment decisions, Launch Africa is open to exceptions for high-potential startups.

5.Ventures Platform

Ventures Platform is a pan-African early-stage venture capital firm focused on making Series A investments in African entrepreneurs. The company invests across diverse sectors, including enterprise SaaS, digital talent accelerators, fintech, insurtech, health tech, edtech, and agritech.

Their mission is to support visionary and innovative entrepreneurs across Africa who are addressing critical societal challenges.

Industries: Industry-agnostic

Stages: Early Stage (up to Series A)

Number of investments: 75+ companies

Number of deals in Africa (2023): 13 so far

Number of exits: Unspecified

Funds Invested: $1bn

Remarkable portfolio Companies: Paystack, PiggyVest, SeamlessHR

Investment Criteria: Ventures Platform put their major investment criteria in one simple sentence: “We invest in innovative startups with differentiated and defensible market-creating innovations.” Other investment criteria include the following:

- Startups should be at the pre-seed or seed stage

- They should also solve for non-consumption with an African focus

6. Norrsken

Norrsken is a non-profit foundation that invests in both for-profit and nonprofit companies, offering capital, expertise, and networks to drive positive global change.

Their accelerator focuses on “impact startups,” operating with a philanthropic approach rather than a traditional venture capital mindset, with the goal of creating a better world for all.

Industries: Industry-agnostic (but primarily fixated on the technology field)

Stages: Early Stage and Growth stage

Number of investments: 63 companies

Number of deals in Africa (2023): 13 so far

Number of exits: Unspecified

Funds Invested: Unspecified

Remarkable portfolio Companies: SendStack, Revwit, Salad

Investment Criteria: Norrsken invests in impact-oriented companies, ideally focusing on startups in the pre-seed stage. While they prefer ventures that have progressed beyond the idea stage and possess a working MVP or are actively developing one, they welcome applications from anywhere in the world.

7. Mastercard

Mastercard is a global payments technology company that provides a platform for easy payment transaction processing. They initiated an accelerator program called Startup Path, which provides startups access to over 60 Mastercard experts, connections to potential customers, and global corporate brands.

Industries: Significant focus on Fintechs

Stages: Seed, Series A and later

Number of investments: 355+ Startups

Number of deals in Africa (2023): 12 so far

Number of exits: Unspecified

Funds Invested: $15B+ (in capital raised post-program)

Remarkable portfolio Companies: Revolut, Airwallex

Investment Criteria:

Mastercard focuses on impactful investments in sub-Saharan Africa, with an emphasis on localized decision-making. A key requirement is that at least one partner or C-suite member must be based on the continent and involved in the decision-making process. Other key criteria include:

- Investing in sub-Saharan SMEs with ticket sizes ranging from US $50,000 to US $4 million.

- Covering a wide range of sectors, including manufacturing, agribusiness, education, health, technology, tourism, and hospitality.

- Incorporating an impact focus, targeting gaps in the investment ecosystem to drive job creation and income opportunities, particularly for women and young people, with special attention to young women.

- Ensuring financial viability by attracting diverse forms of capital, including private investments.

8. Y Combinator

Y Combinator is a renowned seed-stage venture capital firm and accelerator that invests in early-stage startups across various industries.

Industries: Industry-agnostic

Stages: Early Stage

Number of investments: 4000+ companies

Number of deals in Africa (2023): 10 so far

Number of exits: 351 (as of mid-2021)

Funds Invested: $85bn

Remarkable portfolio Companies: Stripe, AirBnB, DoorDashInvestment Criteria: Surprisingly, there are no rules regarding applying to Y Combinator’s accelerator program. However, they are quite insistent on clear answers to the questions on the application form.

If you have a good idea but cannot communicate that idea clearly enough, your startup won’t be selected. You can find out more details on how to make the best application to Y Combinator here.

9. Catalyst Fund

Catalyst Fund is a pre-seed venture capital (formerly accelerator) that is focused on backing tech startups with an innovative mission to solve climate issues in Africa.

Industries: Fintech, Climate tech (or any other industry focused on solving climate issues or aiding the solution)

Stages: Early Stage

Number of investments: 61 as an accelerator, 10 as a VC fund

Number of deals in Africa (2023): 10 so far

Number of exits: Unspecified

Funds Invested: $40 million (first close of fund)

Remarkable portfolio Companies: Spoon, Graviti, and Koa

Investment Criteria:

Startups applying to the Catalyst Fund must meet the following criteria:

- Focus on empowering underserved and climate-vulnerable communities.

- Teams should include local founders or co-founders and promote gender-balanced leadership.

- Startups should be at the pre-seed stage.

- They should have a product already in the market, gaining a customer base, and actively working toward achieving product-market fit.

10. 500

500 Global is a VC firm that “invests in founders building fast-growing technology companies.” Their focus is on firms with long-term value and the potential to drive economic growth.

Industries: Industry-agnostic

Stages: Early-stage and Growth Stage companies

Number of investments: 2,800+ companies

Number of deals in Africa (2023): 9 so far

Number of exits: Unspecified

Funds Invested: $143 million in South-East Asia alone this year

Remarkable portfolio Companies: Canva, Credit

Investment Criteria:

Startups applying for investment in this venture capital must meet the following criteria:

- Have a cross-functional team with expertise in design, engineering, and marketing.

- Focus on solving specific problems for a well-defined target customer.

- Be operational with less than $1 million in external financing.

- Demonstrate the ability to secure the next funding round.

- Have a functional prototype or a track record of product success.

- Show measurable traction and scalability.

Conclusion

Despite a decline in overall funding for African startups in 2023, the entrepreneurial ecosystem remains vibrant and full of potential. The venture capital firms listed continue to actively invest, signalling their confidence in the growth and opportunities within Africa’s startup ecosystem.

Share this article

Leave a Reply