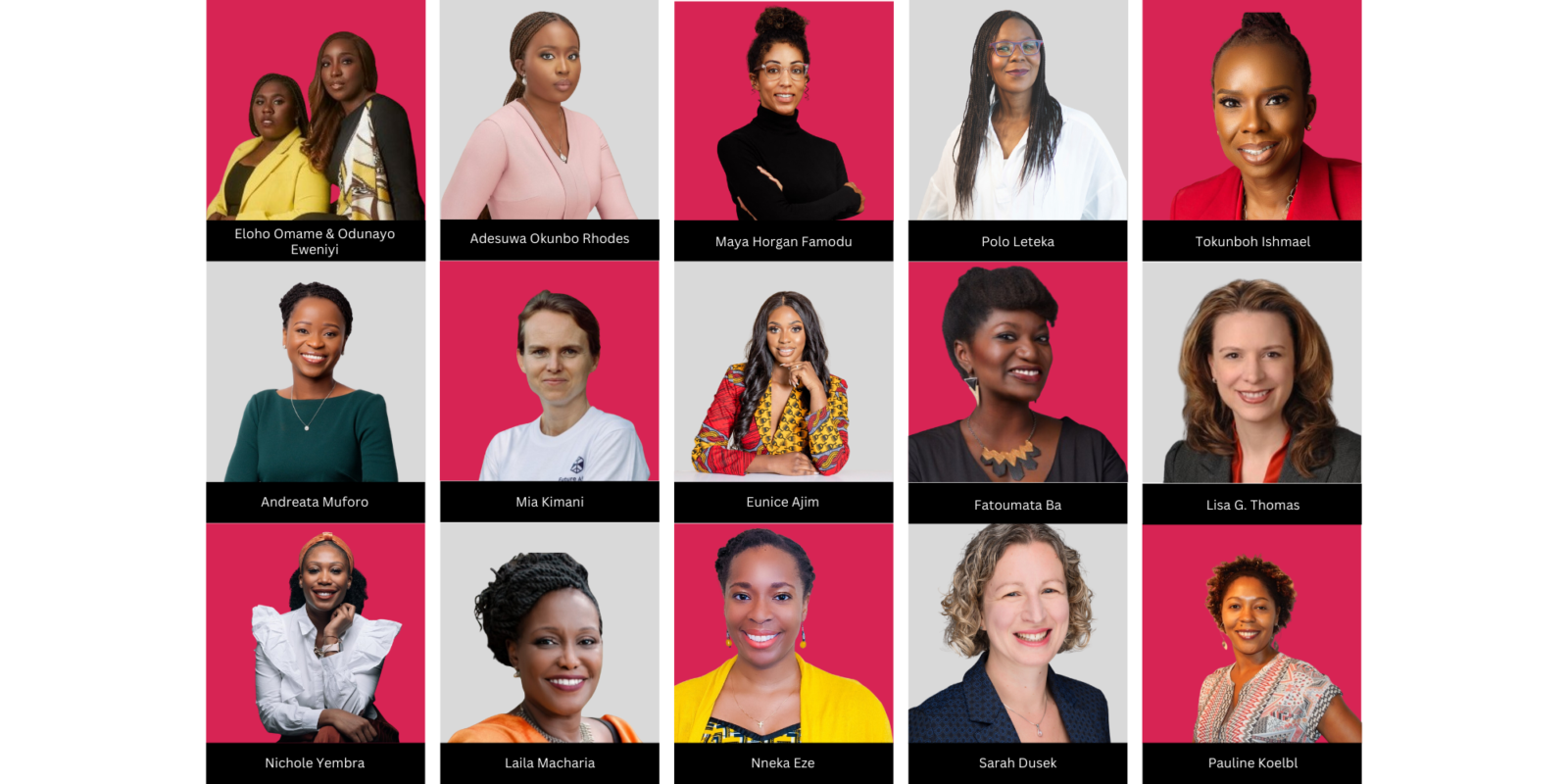

Eloho Omame, Odunayo Eweniyi

Co-founder, FirstCheck Africa

Founded in 2021, FirstCheck Africa, led by Eloho Omame and Odunayo Eweniyi, focuses on bridging the gender funding gap by investing in female-led startups across Africa.

Both founders are prominent in the African tech ecosystem, with Odunayo also being a co-founder of PiggyVest.

| Industries they invest in | Sector Agnostic |

| Stages they invest in | Pre-seed and Seed Stage |

| Investments | 11 |

| Exits | 0 |

| Funds raised | Closed at $10M, later increased to $12M with TLcom’s $2M commitment |

| Remarkable Portfolio Company | Healthtracka: A Nigerian health-tech startup offering at-home lab testing and health services to make healthcare more accessible and convenient. |

| Investment Criteria: | |

| Inclusivity | Emphasis on women-led businesses and underrepresented entrepreneurs. |

| Impact | Solutions addressing significant social and economic challenges. |

| Scalability | Potential for sustainable growth at scale. |

Adesuwa Okunbo Rhodes

Founder, Aruwa Capital

Founded in 2019 by Adesuwa Okunbo Rhodes, Aruwa Capital is a private equity and impact investment firm focused on empowering female entrepreneurs and promoting economic inclusion in West Africa.

With over a decade of experience in private equity and investment banking, Adesuwa is committed to bridging the gender investing gap and fostering sustainable development through strategic investments.

| Industries they invest in | Healthcare, Consumer Goods, Agriculture, Financial Services, Education, Renewable Energy |

| Stages they invest in | Growth stage, Early growth stage, Expansion stage |

| Investments | 10 |

| Exits | 0 |

| Funds raised | Closed first institutional fund at over $20 million in 2022 |

| Remarkable Portfolio Company | Wemy Industries: A Nigerian manufacturer of personal hygiene products |

| Investment Criteria: |

| Focuses on companies that serve women or are female-led |

| Must have women in leadership, workforce, or value chain |

| Companies with revenue between $300,000 and $500,000 |

Maya Horgan Famodu

Founder, Ingressive Capital

Ingressive Capital, founded in 2017 by Maya Horgan Famodu, is a venture capital firm based in Lagos, Nigeria. The firm focuses on investing in early-stage technology startups across Africa.

Maya’s vision is to support startups with the potential to transform the continent through innovation and technology. Leveraging an extensive network and deep local market understanding, Ingressive Capital provides startups with the resources and capital needed to scale.

| Industries they invest in | Fintech, Autotech, Agritech, Health Tech, Entertainment, Internet/ISP, SaaS Cloud, Logistics & Transportation |

| Stages they invest in | Pre-seed and Seed Stage |

| Investments | 40 |

| Exits | Several Exits |

| Funds raised | $60 million |

| Remarkable Portfolio Company | Paystack |

| Investment Criteria: |

| Technology-driven solutions |

| Scalable business model with regional/national potential |

| Strong founding team with clear vision and execution plan |

Polo Leteka

Founder, IDF Capital

IDF Capital, founded in 2008 by Polo Leteka, is a South African-based private equity and venture capital firm. The firm is focused on empowering small and medium-sized enterprises (SMEs) across Africa, particularly black-owned and women-led businesses.

Polo Leteka established IDF Capital to close the funding gap for underserved businesses and promote inclusive economic growth through capital, strategic support, and mentorship.

| Industries they invest in | Sector Agnostic |

| Stages they invest in | Early Growth, Expansion Stage |

| Investments | 296 |

| Funds raised | Managed several funds, including Women Entrepreneurs Fund (WEF) and SME Fund |

| Remarkable Portfolio Company | Reelfruit |

| Investment Criteria: |

| At least 51% black-owned and operated |

| Proven business model with at least six months of revenue |

| Scalable and profitable business with strong management and governance |

Tokunboh Ishmael

Position: Co-Founder, Alitheia Capital

Founded in 2007 by Tokunboh Ishmael, Alitheia Capital is a leading impact investment firm based in Lagos, Nigeria. The firm aims to promote social and economic development across Africa by investing in businesses that create measurable positive impacts.

Tokunboh Ishmael, an experienced private equity and venture capital professional, leads the firm’s efforts to address gender inequality, economic inclusion, and sustainable development.

| Industries they invest in | Fintech, Consumer Goods & Services, Technology, Manufacturing, Logistics & Mobility, Healthcare, Agribusiness, Waste Management, Clean Energy |

| Stages they invest in | Seed to Series B |

| Investments | 23 |

| Exits | 0 |

| Funds raised | $100 million Alitheia IDF Fund |

| Remarkable Portfolio Company | SweepSouth, a South African online home services platform |

| Investment Criteria: |

| Minimum of two years of operating history |

| Strong corporate governance framework |

| Proven cash flows from an established customer base |

| Potential for 3.0x MoM and significant social impact |

Andreata Muforo

Partner, TLcom Capital LLP

TLcom Capital LLP is a venture capital firm with a strong presence in Africa, focusing on technology-driven businesses. Andreata Muforo, one of the firm’s key partners, plays a crucial role in driving investment in innovative startups.

The firm invests in scalable tech companies that are creating a significant impact across Africa, leveraging a mix of global and local expertise to support entrepreneurs.

| Industries they invest in | Multi-Sector |

| Stages they invest in | Early Stage |

| Investments | 32 |

| Exits | 15 |

| Funds raised | $225 million |

| Remarkable Portfolio Company | Andela: A Nigerian startup that develops software developers across Africa and connects them with global companies. |

| Investment Criteria: | |

| Innovation | Technology-driven solutions addressing significant problems. |

| Scalability | Business models with potential for regional or international expansion. |

| Impact | Companies must have potential for positive social and economic impact. |

Mia Kimani

Managing Partner, Future Africa

Future Africa, founded by Iyinoluwa Aboyeji, is committed to backing mission-driven innovators in Africa. Mia Kimani, the Managing Partner, helps steer the firm’s investment strategy.

The firm focuses on early-stage startups using technology to solve pressing challenges in Africa, particularly those aiming to transform sectors like education, healthcare, and finance.

| Industries they invest in | Fintech, HealthTech, EdTech, Agritech, E-commerce, EnergyTech |

| Stages they invest in | Pre-seed and Seed Stage |

| Investments | 64 |

| Exits | 4 full exits, 1 partial exit |

| Funds raised | $20 million+ |

| Remarkable Portfolio Company | 54gene: A healthtech startup focusing on genomics research using African genetic data to improve global health outcomes. |

| Investment Criteria: | |

| Mission-Driven Founders | Passionate about solving critical problems and driving change. |

| Innovation | Technology solutions addressing significant market gaps. |

| Trust-Based Relationships | Sources companies through trusted networks, focusing on early-stage support. |

Eunice Ajim

Founder, Ajim Capital Fund

Ajim Capital Fund, founded by Eunice Ajim in 2021, is dedicated to supporting early-stage African startups. The fund focuses on bridging the financing gap for tech entrepreneurs across the continent.

Ajim, an entrepreneur herself, brings her passion for empowering African innovators, with a goal of creating a billion-dollar venture capital fund that transforms Africa’s startup ecosystem.

| Industries they invest in | Fintech, HealthTech, EdTech, Enterprise Software, Logistics and Mobility, E-commerce |

| Stages they invest in | Pre-seed and Seed Stage |

| Investments | 11 |

| Exits | 1 full exit, 1 partial exit |

| Funds raised | $10 million+ |

| Remarkable Portfolio Company | Clafiya: A healthtech startup providing healthcare services to underserved communities by connecting patients with local health practitioners. |

| Investment Criteria: | |

| Founder-Driven Companies: | Led by visionary entrepreneurs committed to solving critical challenges. |

| Scalability and Market Potential: | High growth opportunities. |

| Technology-Driven Solutions: | Innovations leveraging technology for market impact. |

Fatoumata Ba

Founder, Janngo Capital

Janngo Capital is a venture capital firm that invests in “tech for good,” particularly in women-led or women-focused companies. Founded by Fatoumata Ba, the firm is committed to fostering job creation and economic inclusion across Africa, with a focus on startups that create social impact.

Ba’s leadership ensures the firm targets ventures with transformative potential, especially for youth and women.

| Industries they invest in | Healthcare, Logistics, Financial Services, Retail, Food and Agribusiness, Mobility, Creative Industry |

| Stages they invest in | Seed Stage, Series A |

| Investments | 17 |

| Exits | 0 |

| Funds raised | $63 million+ |

| Remarkable Portfolio Company | YoLa Fresh: An agritech startup revolutionizing the fresh food supply chain by connecting farmers directly with retailers and reducing food waste. |

| Investment Criteria: | |

| Social Impact | Startups must improve access to essential goods and services. |

| Job Creation | Companies should focus on creating jobs at scale, especially for women and youth. |

| Scalability | Businesses with high growth potential and sustainability. |

Lisa G. Thomas

Founder, Samata Capital

Samata Capital, founded by Lisa G. Thomas, focuses on promoting inclusive and sustainable economic growth in emerging markets. The firm is dedicated to supporting underrepresented entrepreneurs and fostering equality in business.

Thomas brings her experience as an investor and entrepreneur to lead investments in ventures that drive positive social change, with a strong emphasis on diversity and inclusivity.

| Industries they invest in | Healthcare, Financial Services, Consumer Goods, Agribusiness |

| Stages they invest in | Seed Stage, Series A |

| Investments | 4 |

| Exits | 2 |

| Funds raised | $10 million+ |

| Remarkable Portfolio Company | ReelFruit: An agribusiness venture that processes and packages dried fruit snacks, promoting sustainable agricultural practices and empowering farmers. |

| Investment Criteria: | |

| Inclusivity | Emphasis on women-led businesses and underrepresented entrepreneurs. |

| Impact | Solutions addressing significant social and economic challenges. |

| Scalability | Potential for sustainable growth at scale. |

Nichole Yembra

Founder, The Chrysalis Capital

Founded in 2019 by Nichole Yembra in Lagos, Nigeria, The Chrysalis Capital focuses on early-stage tech companies in Africa and the Diaspora. Nichole, the Managing Partner, has extensive experience in finance, having previously served as CFO at Venture Garden Group.

The firm aims to drive innovation in sectors such as agriculture, renewable energy, security, healthcare, education, and financial technology to foster growth within the African tech ecosystem.

| Industries they invest in | Agriculture, Renewable Energy, Security, Healthcare, Education, FinTech |

| Stages they invest in | Seed Stage, Series A |

| Investments | 11 |

| Exits | 1 |

| Remarkable Portfolio Company | Bamboo: A platform that provides access to a wide range of investment options, including global stocks, enabling customers to diversify their portfolios and manage their investments more effectively. |

| Investment Criteria: | |

| Innovative Leadership | Investing in startups led by visionary and innovative founders. |

| Scalable Solutions | Focus on companies with technologies that can scale and address significant market needs. |

| Impactful Sectors | Emphasis on sectors that offer solutions to critical challenges in emerging markets. |

Laila Macharia

Founder, Centum Investment

Centum Investment Company, established in 1967 and based in Nairobi, Kenya, is a leading private equity firm founded by Laila Macharia. With over 20 years of experience, Laila has significantly contributed to Kenya’s corporate landscape.

Centum focuses on various sectors, including real estate, infrastructure, and financial services, and aims to create substantial economic growth and social impact across East Africa as Kenya’s largest publicly traded investment group.

| Industries they invest in | Real Estate, Infrastructure, Financial Services, Consumer Goods, Energy, Education, Technology |

| Stages they invest in | Seed Stage, Series A |

| Investments | 42 |

| Exits | 22 |

| Investment Criteria: | |

| Strong Management Teams | Look for businesses with exceptional management teams that have a proven track record. |

| Growth Potential | Companies must offer significant growth and diversification potential. |

| Profitability | Target companies should be profitable with an EBITDA exceeding USD 5 million. |

Nneka Eze

Founder, Vested World

Founded in 2014 and headquartered in Chicago, Illinois, VestedWorld is an Africa-focused venture capital firm led by Managing Partner Nneka Eze.

With experience at firms like McKinsey & Company, Nneka aims to deliver impactful financial returns by investing in startups across agriculture, consumer goods, and enabling technologies in East and West Africa. The firm emphasizes economic development while addressing critical market needs.

| Industries they invest in | Agriculture/AgrifoodTech, Consumer Goods, Enabling Technology |

| Stages they invest in | Pre-Series, Series A |

| Investments | 35 |

| Exits | 2 |

| Funds raised | $28 million+ |

| Remarkable Portfolio Company | Shuttlers : A leading tech bus-sharing service |

| Investment Criteria: | |

| Impact and Returns | Startups should show potential for significant impact and financial returns. |

| Innovative Solutions | Companies should leverage technology to create innovative solutions addressing market gaps. |

| Experienced Founders | Companies should be led by founders with expertise and a deep understanding of their markets. |

Sarah Dusek

Founder, Enygma Ventures

Established in 2019 in Cape Town, South Africa, Enygma Ventures focuses on empowering women-led businesses in Southern Africa.

Co-founded by Sarah Dusek, who has a strong entrepreneurial background, the firm supports early-stage companies in sectors where women can create significant impact, including fintech, health tech, education tech, consumer goods, and agriculture, aiming for economic and social transformation through investment.

| Industries they invest in | Fintech, HealthTech, EdTech, Consumer Goods, AgriTech |

| Stages they invest in | Pre-Seed Stage, Seed Stage |

| Investments | 23 |

| Exits | 4 |

| Funds raised | Over $6 million |

| Remarkable Portfolio Company | Koa Academy |

| Investment Criteria: | |

| Women-Led Businesses | Preference for companies led by women or with significant female leadership. |

| Innovation and Impact | Startups should provide innovative solutions addressing critical challenges. |

| Scalability | Businesses should show clear potential for growth and expansion. |

| Experienced Founders | Companies should be led by founders with expertise and a deep understanding of their markets. |

Pauline Koelbl

Founder, ShEquity Ventures

Founded in 2020 by Pauline Koelbl, ShEquity is a venture capital firm based in Mauritius that supports female-led impactful startups across Africa. Pauline, an expert in gender-lens impact investing, leads the firm with the mission to bridge the gender investment gap.

ShEquity focuses on technology, renewable energy, FMCG, digitalization, fintech, hospitality, and agriculture, targeting early-stage startups that offer innovative solutions with significant social and economic impact.

| Industries they invest in | Technology-Enabled Solutions, Renewable Energy, FMCG, Digitalization, Fintech, Hospitality, AgriTech, Healthcare |

| Stages they invest in | Pre-Seed Stage, Seed Stage |

| Investments | 11 |

| Exits | 2 |

| Remarkable Portfolio Company | Ecodudu |

| Investment Criteria: | |

| Female Leadership | Preference for companies led by women or with significant female leadership. |

| Impact and Innovation | Startups must offer innovative solutions with potential for substantial impact. |

| Scalability | Businesses should show significant growth potential. |

Conclusion

The emergence of venture capital firms dedicated to funding female-led startups represents a significant evolution in the investment landscape, particularly across Africa.

These 15 firms are not only addressing the gender investment gap but also driving economic growth by empowering women entrepreneurs and supporting innovative solutions across diverse sectors.

Leave a Reply